Top HSA-Eligible Medical Devices to Save on Healthcare Costs

Managing healthcare expenses is a priority for many individuals and families, and Health Savings Accounts (HSAs) provide a valuable way to save on qualified medical expenses. One of the advantages of an HSA is that it allows you to purchase certain medical devices using pre-tax dollars, effectively reducing your out-of-pocket costs while supporting your health. Understanding which medical devices are HSA-eligible can help you make informed choices and maximize your savings.

What Are HSA-Eligible Medical Devices?

HSA-eligible medical devices are products that the IRS recognizes as necessary for medical care or treatment. When purchased with HSA funds, these devices are tax-free, meaning you don’t pay federal income tax on the money used. Eligibility extends to a wide range of items, from everyday healthcare tools to specialized equipment that supports chronic conditions or recovery.

Common examples include blood pressure monitors, glucose meters, mobility aids, and certain first aid supplies. While the list is extensive, ensuring that a device is HSA-eligible before purchase is crucial to avoid tax complications.

See also: The Future of Tech: Emerging Trends to Watch

Benefits of Using HSA Funds for Medical Devices

- Tax Savings: Using pre-tax HSA dollars lowers your taxable income, effectively reducing your annual tax burden. This can lead to significant savings, especially when purchasing higher-cost devices.

- Cost Management: By paying for medical devices with HSA funds, you can manage healthcare expenses more efficiently, spreading costs across tax-advantaged funds rather than relying solely on out-of-pocket spending.

- Health Support: HSA-eligible devices often promote proactive health management, enabling individuals to monitor conditions like blood pressure, blood sugar, or sleep patterns, leading to better overall wellness.

- Long-Term Use: Many devices, such as durable mobility aids or home diagnostic tools, can be used repeatedly, giving you continued value from your investment and supporting ongoing healthcare needs.

Top HSA-Eligible Medical Devices to Consider

1. Blood Pressure Monitors

Monitoring blood pressure at home is essential for managing hypertension and preventing heart-related complications. HSA-eligible blood pressure monitors range from basic models to advanced digital monitors with memory tracking, allowing you to maintain accurate records for your healthcare provider.

2. Glucose Meters and Testing Supplies

For individuals with diabetes, HSA-eligible glucose meters and test strips are invaluable. These devices allow regular blood sugar monitoring, helping to maintain optimal health and avoid costly complications.

3. Thermometers

Accurate temperature measurement is a cornerstone of home healthcare. Digital thermometers, infrared thermometers, and even advanced wearable devices that track temperature trends are often HSA-eligible, making them a practical and cost-effective investment.

4. Mobility Aids

Devices like canes, walkers, crutches, and wheelchairs support mobility for those recovering from injury or managing chronic conditions. HSA coverage ensures that you can acquire these essential aids without extra financial strain.

5. First Aid and Health Monitoring Kits

Basic first aid kits, blood pressure cuffs, pulse oximeters, and other monitoring devices qualify for HSA use. These tools allow you to respond to minor medical issues at home and track vital signs, promoting timely intervention and reducing the need for urgent care visits.

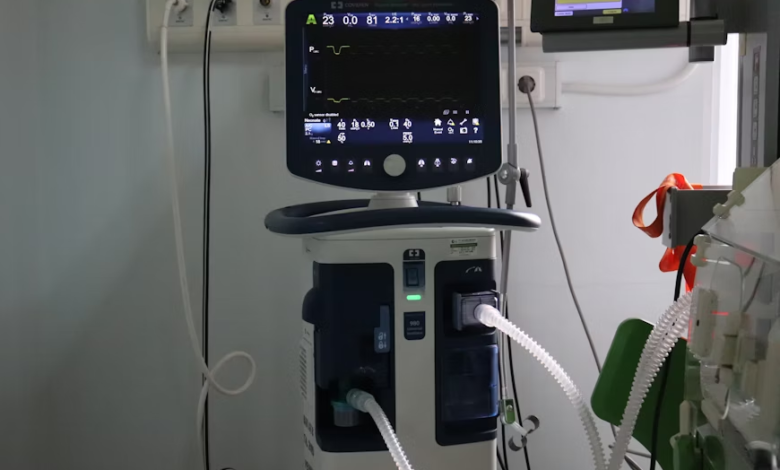

6. Sleep and Respiratory Devices

Certain CPAP machines, sleep apnea monitors, and other respiratory aids are HSA-eligible. These devices support better sleep and overall health, which can prevent more serious medical conditions in the long term.

Tips for Purchasing HSA-Eligible Devices

- Check Eligibility: Always verify that a device is explicitly listed as HSA-eligible by your HSA provider or IRS guidelines before purchasing.

- Keep Receipts: Maintain records of your purchases to document HSA spending in case of an audit.

- Use HSA Cards: Most HSA accounts provide debit cards specifically for healthcare purchases, making transactions quick and convenient.

- Consider Durability: Investing in high-quality devices ensures long-term use and reduces the likelihood of needing frequent replacements.

- Plan Ahead: Budget your HSA funds for essential devices throughout the year, prioritizing items that will deliver the most health benefits.

Conclusion

HSA-eligible medical devices offer a practical way to manage healthcare costs while supporting personal wellness. From blood pressure monitors and glucose meters to mobility aids and sleep devices, these tools help individuals take a proactive approach to health management. By leveraging HSA funds, you can purchase necessary medical devices with pre-tax dollars, making healthcare more affordable and accessible. Staying informed about eligible devices, planning purchases carefully, and choosing high-quality equipment ensures that your investment provides lasting value for your health and financial well-being.